Effective business planning requires clear market understanding. TAM, SAM, and SOM provide the foundation for strategic decision-making.

These metrics reveal your market’s true scope, enable realistic revenue forecasting, and create compelling investor propositions. Understanding them properly can transform your business strategy.

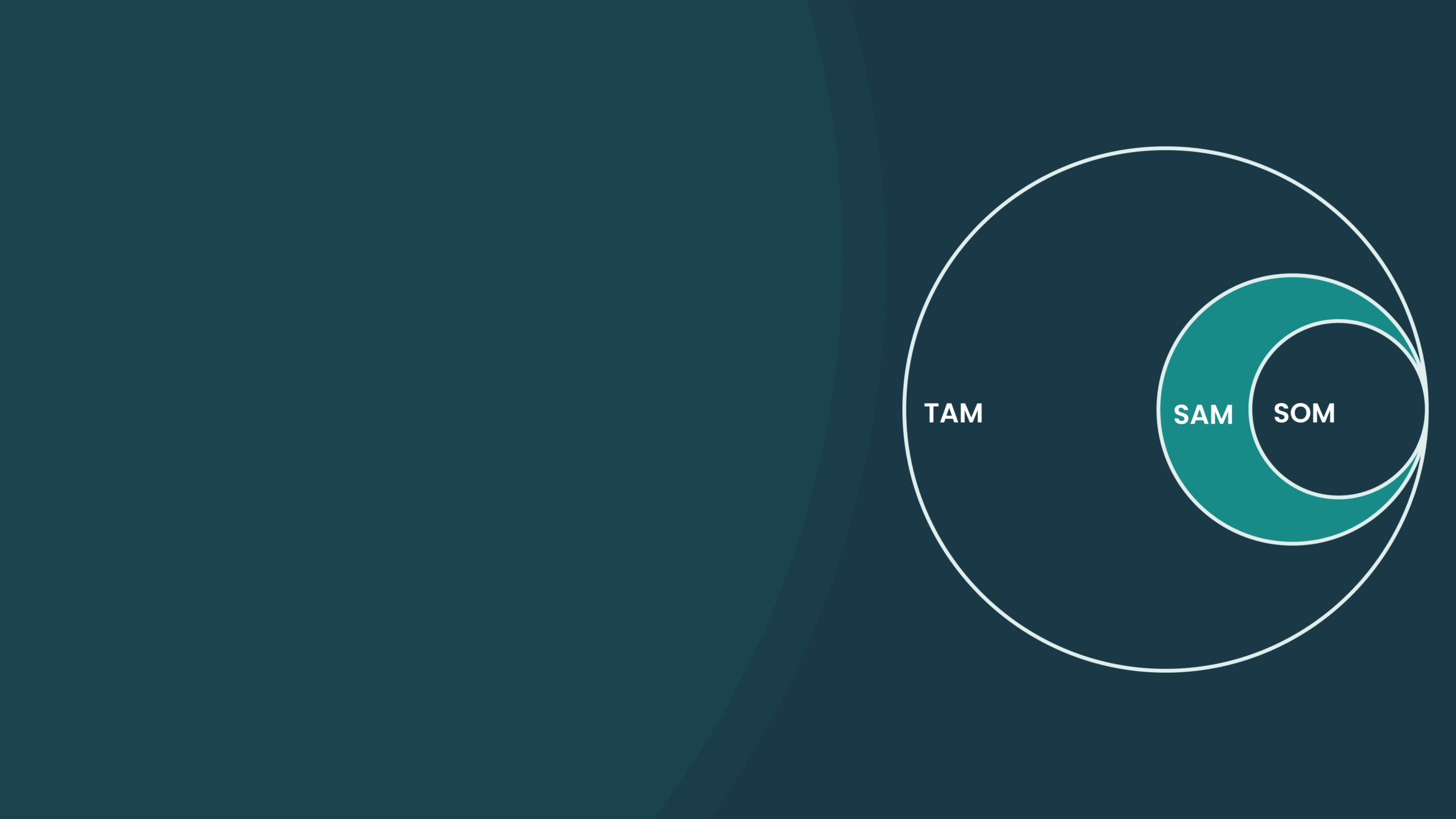

Understanding TAM, SAM, and SOM

Three critical metrics define market opportunity:

TAM: Total Addressable Market

The complete demand for your product or service across all potential customers. This represents maximum market potential without constraints – or your theoretical ceiling if every possible customer bought from you.

SAM: Serviceable Addressable Market

The portion of TAM your business can realistically target given geographical, regulatory, or operational limitations. This reflects genuine market opportunity within your operational scope.

SOM: Serviceable Obtainable Market

The market share you can realistically capture in the short to medium term. This accounts for competition, resources, and market penetration capabilities.

Why TAM Matters

Total Addressable Market provides essential context for strategic planning. It demonstrates growth potential to investors and helps justify resource allocation decisions.

For UK businesses, TAM calculations must consider regulatory environments, consumer behaviour patterns, and market maturity. Brexit implications may also affect European market access calculations for example.

Calculating TAM: Two Approaches

Top-Down Analysis

Start with industry reports and market research, then narrow to your specific context. Useful for established markets with reliable data.

Bottom-Up Analysis

Build from your current customer data and extrapolate upwards. More accurate for niche markets or when you have strong customer insights.

Both methods require accuracy. Overestimating creates unrealistic expectations; underestimating limits strategic vision.

SAM: Your Realistic Market Opportunity

Serviceable Addressable Market represents achievable opportunity within operational constraints.

Defining Your SAM

Consider factors that limit market access:

- Geographic coverage capabilities

- Regulatory compliance requirements

- Product feature limitations

- Distribution channel constraints

- Cultural or language barriers

For UK businesses expanding internationally, SAM calculations must account for market entry costs, local competition, and regulatory differences.

Calculating SAM Effectively

Use market research combined with operational analysis. Consider your current capabilities, planned expansion, and resource constraints.

The result should align with medium-term strategic plans and resource allocation capabilities.

SOM: Setting Achievable Goals

Serviceable Obtainable Market defines realistic short-term market capture.

Understanding SOM Context

SOM represents the market share achievable within 2-3 years given current competitive dynamics and resource levels.

For a UK fintech startup, SOM might represent the percentage of London-based SMEs you can realistically acquire within 18 months, considering competitor presence and customer acquisition costs.

Determining Realistic SOM

Base calculations on:

- Current sales performance

- Market growth trends

- Competitive analysis

- Resource availability

- Customer acquisition capabilities

SOM must be credible. Overambitious projections undermine investor confidence and strategic planning.

Strategic Impact of Market Sizing

Understanding TAM, SAM, and SOM transforms business strategy:

Strategic Planning: Enables realistic goal-setting and resource allocation based on genuine market opportunity rather than aspiration.

Investment Decisions: Provides data-driven foundation for funding requests and investor presentations.

Product Development: Guides feature prioritisation and development roadmaps based on addressable market needs.

Marketing Focus: Ensures marketing spend targets genuinely accessible customers rather than theoretical audiences.

Competitive Positioning: Reveals market gaps and competitive opportunities within serviceable markets.

Calculating Your Market Metrics

Bottom-Up Methodology

Start with concrete business data:

- Analyse current customer base and revenue per customer

- Identify expansion opportunities within existing segments

- Extrapolate to similar market segments

- Build comprehensive market picture from reliable foundations

This approach suits established businesses with solid customer data.

Top-Down Methodology

Begin with market research:

- Source industry reports and market studies

- Apply relevant filters (geographic, demographic, behavioural)

- Refine estimates based on competitive landscape

- Validate against business capabilities

Effective for new market entry or when lacking customer data.

Key Considerations for UK Businesses and StartUps

Regulatory Environment: Factor in UK-specific regulations affecting market access and operational requirements.

Post-Brexit Dynamics: Consider changed relationships with European markets and new trade arrangements.

Regional Variations: Account for significant differences between London, Northern England, Scotland, Wales, and Northern Ireland markets.

Economic Factors: Include inflation, interest rates, and consumer spending patterns in market sizing calculations.

Best Practices

Maintain Realism: Ground all calculations in verifiable data rather than optimistic projections.

Regular Reviews: Market conditions change. Update calculations quarterly to maintain strategic relevance.

Cross-Validation: Use multiple methodologies to validate market size estimates.

Document Assumptions: Clear assumptions enable better strategic discussions and periodic reviews.

Consider Seasonality: UK markets often show seasonal patterns that affect annual market calculations.

Common Pitfalls

Overestimating TAM: Creates unrealistic expectations and strategic misdirection.

Ignoring Competition: Failing to account for competitive market share reduces SOM accuracy.

Static Thinking: Markets evolve. Regular recalculation ensures continued strategic relevance.

Geographic Oversimplification: Treating the UK as homogeneous ignores significant regional market differences.

Investor Perspectives

Investors evaluate TAM, SAM, and SOM to assess:

- Market opportunity scale

- Realistic growth potential

- Management team market understanding

- Strategic planning capabilities

Well-researched market sizing demonstrates business acumen and strategic thinking that attracts quality investment.

Conclusion

TAM, SAM, and SOM provide essential frameworks for strategic planning, resource allocation, and investor communication.

Success requires balancing ambition with realism, thorough market research with practical constraints, and growth potential with achievable execution.

Regular review and refinement ensure these metrics remain strategically relevant as markets and businesses evolve.

Need help calculating your market opportunity or developing strategic plans based on market sizing? Get in touch to discuss how market analysis can drive your business growth.