In early 2018, it was reported that Harrods Bank would disappear and be fully rolled into Tandem. Tandem is one of many challenger banks that I’ve been monitoring over the last 3+ years, in fact I drafted the first version of this post a little less than 18 months ago (I even got some colleagues to give 2 rounds of feedback) but just wasn’t happy with what I’d put down so far. However, there’s now a potential for a migration and that acted as a trigger to invest some time in the post again.

(brief) History of the challenger banks

So, let’s firstly rewind and look at a time line of the so called digital challenger banks; Atom, Monzo, Revolut, Curve, Starling Bank, Loot, Pockit, Uaccount and Tandem:

- 2013 – Bank of England (BofE) announced a streamlined 2 step process (with lower capital requirements) for setting up new banks.

- 2013 – YouGov survey – 84% of respondents agreed with the statement “bankers are greedy and get paid too much”

- 2015 – 2 mobile only banks obtain licences from the BofE – 1st Atom and then Tandem

- 2016 – 6 banks are part-way through the process of applying for a licence, while another 14 have held pre-application talks with the Prudential Regulation Authority (PRA)

- 2016 – UK’s first app-based digital bank Atom is launched

- 2017 – In March, Tandem forfeit licence after losing out on funding from House of Fraser parent company Sanpower Group.

- 2017 – August sees Tandem announce they are buying Harrods Bank.

Despite digital bank brands creating an almost cult online following, they are not without their own challenges. Equally, older banks face the challenges of changing customer expectations.

“The emergence of new technologies into banking has had a permanent impact….. customer expectations for banking services (both offline and online) are being reset by the experiences being provided by retailers and online providers, elsewhere.”

PwC, The Digital Tipping Point

Marketing vs compliance

I’ve been working on search marketing for financial brands for the last 7 years; banks, trading companies and insurers. For at least 3 of those years a common thread has existed; the threat of being out paced by the emerging fintech brands. It’s high stakes too Goldman Sachs estimates the industry is worth $4.7 trillion.

A challenge shared by clients is the unwillingness/difficulty/red tape of financial processes. Don’t get me wrong, I understand the need for these but it does mean making changes to sites and therefore moving forward in SEO is difficult and often political. These challenges are born out of the objectives and character types that marketing and compliance staff have, but in this case I’m looking at the opportunity cost:

“Being able to make changes to your website quickly is a competitive advantage” via @Mikerjeffs

— Tim Grice (@Tim_Grice) February 3, 2017

Character traits of challenger and existing banks

There are different character traits in how challenger fintech brands and the established banking brands we’ve become accustomed to, operate:

Challenger/fintech:

- Young – typically no older than 2/3 years

- Require investment

- Utilise the latest tech

- Unburdened by regulators, legacy IT systems, branch networks—or the need to protect existing businesses

Existing institution:

- Old – many banking systems were put in place in the 1980s

- Trusted (kind of)

- established (tied in) customer base

- Brand awareness

- Regulated, local presence

New tech vs old tech

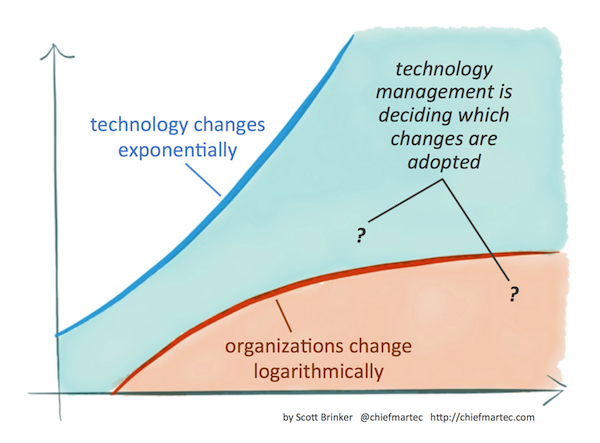

Broadly speaking, we can apply Martech Law to the fintech landscape:

- Challenger brands (tech savvy) can move faster and have less complex processes – exponential.

- Older, established brands/organisations move slower and have more processes built on older technology – logarithmic

An important point to note here is that technological change mirrors that of social change – i.e new technologies are more widely accepted:

“Customers’ digital expectations are set by their best digital experiences. This means they are comparing their banking experience to Uber, Starbucks and their favourite takeaway app – not the competitors most banks are focused on.”

via Brett Thornton.

“Through the use of digital technology we are in contact with our bank more than ever before. And for the first time customers are preferring to use mobile apps more than banks’ websites. In fact people are using apps more than all other forms of banking put together – eg branch, telephone and online.”

via BBA.org.uk

“Fintechs forced banks to innovate their digital offerings and even their business models. While this first wave of intrusion has mostly abated, platform companies such as China’s Tencent, Japanese retailer Rakuten, and Amazon in the United States are now using their customer knowledge, scale advantage, and data capabilities to target a range of retail, corporate, and commercial segments.”

Low authority vs high authority

What we’re seeing across our client base is that a lot of well trusted brands often face challenges of not being able to capitalise on the latest tech, which means they can’t take advantage of positive signals as quickly as newer brands. The balance, however, is that older brands often hold more domain authority so if they are able to get a new page live, that domain authority will give them a good chance of ranking:

A new page on a “high authority” domain still likely to do better than a new page on a “low authority” domain.

Google’s *technically* right https://t.co/k43YPnxh1C

— Will Critchlow (@willcritchlow) March 24, 2017

Migration

So let’s get back to that migration, since the announcement harrodsbank.co.uk has been rebranded to the Tandem.co.uk site, with no initial signposting. They’ve opted to create a welcome to Tandem holding page, which we have as recommended practice in our migration best practice guide – If a searcher clicks a result expecting a particular product or piece of information the new landing page should meet that intent or make it easy for users to click through to a page that will.

It appears as though some parts of the Harrods Bank website are still accessible albeit rebranded which if I’m honest I’d find confusing:

This could be one of the reasons that Tandem’s visibility is relatively volatile and has been since part migrating the Harrods Bank pages:

Also though, a title tag or two might help 😉 It looks as though Tandem are somewhere between Andrew Parker’s no 2 and no 3 points; reasons why your migration didn’t go as planned.

Fintech/challenger bank landscape

Right, back to the title of this post: How do the challenger banks compare in search:

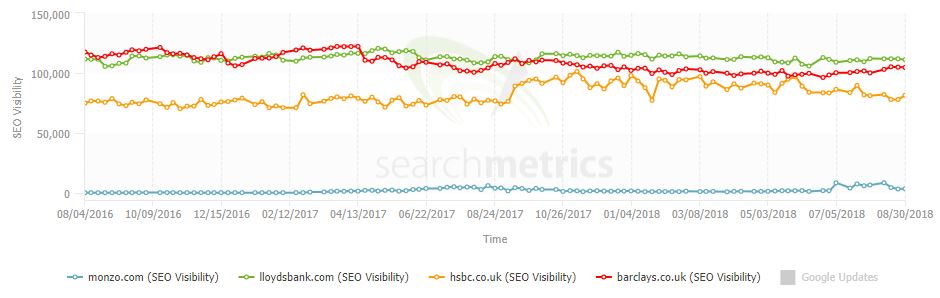

Monzo are leading the way in terms of visibility (based on SearchMetrics above), although it’s a two horse race due to what I believe are the big four challengers (and so do Tech Crunch): Monzo, Starling, Tandem and early trail blazers Atom. On a side note, recent spikes in Monzo’s visibility are likely due to temporarily ranking for ‘ticketmaster’ due to a post they have relating to the breach in June 2018.

Monzo vs Starling

Monzo vs Starling is quite an interesting story, given that Monzo co-founder, Tom Bloomfield is a former employee of Starling Bank (previously named ‘Bank Possible).

You can read more here about some fun competitive exchanges between the two brands:

Monzo vs traditional banks

In comparison with the more traditional banks Monzo are understandably way off. So much so that it’s almost pointless showing the chart:

*updated

However, based on current trends (Dec 2018, that gap is only going to get smaller and smaller…